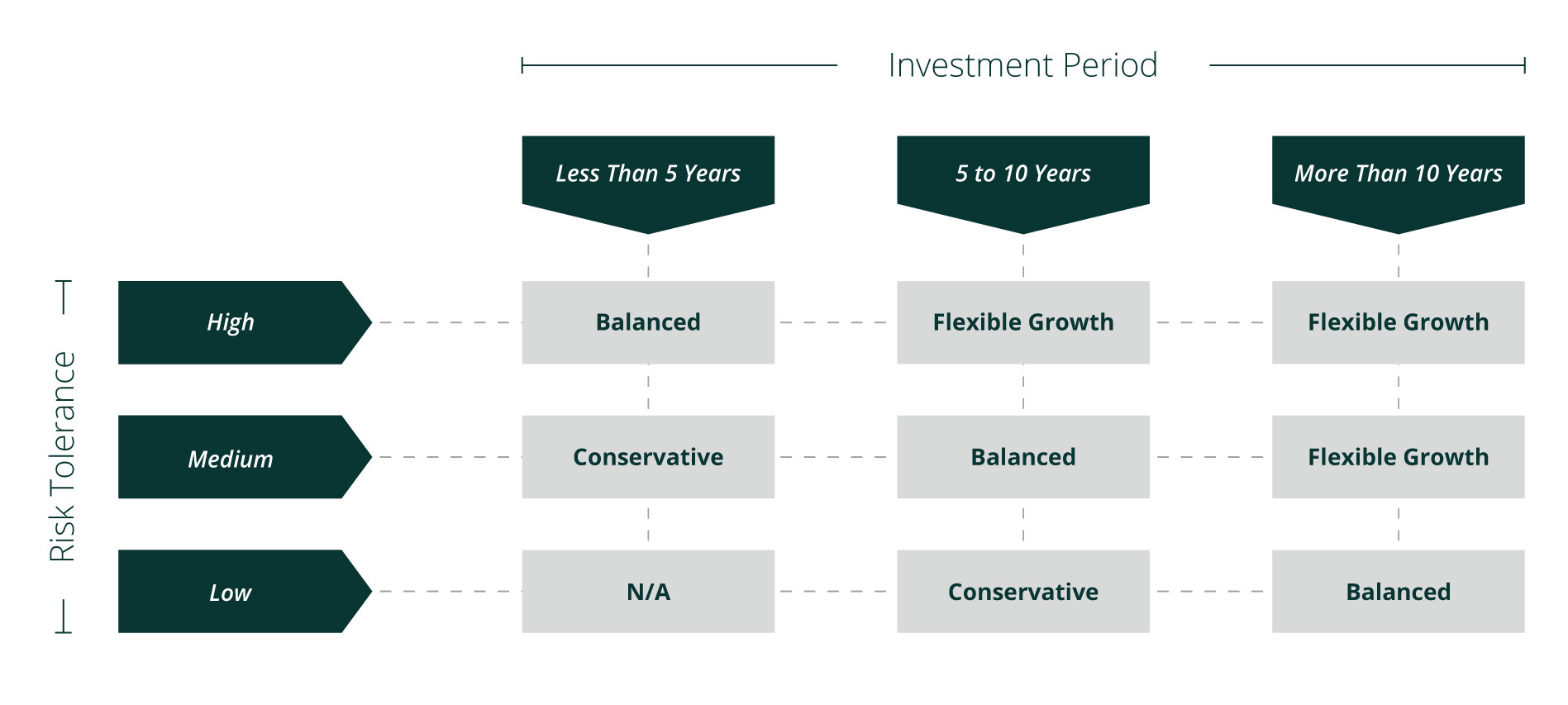

All of our portfolios are individually managed and tailored to your individual investment needs. We offer diverse portfolios with distinct levels of risk and expected returns. Take a look at the table below and read the corresponding descriptions to find out which portfolio strategy is right for your investment objectives

Flexible Growth Portfolio

High-Risk Tolerance

Managed with the goal of maximizing long-term investment returns through a portfolio consisting primarily of stocks. This portfolio is designed for investors willing to accept significant short-term volatility in the pursuit of superior long-term investment returns. An options hedging strategy is available for this portfolio.

Balanced Portfolio

Medium-Risk Tolerance

The asset allocation mix of stocks, fixed income, and cash equivalents has a target equity exposure of approximately 75%. This portfolio is designed for investors willing to accept a slightly diminished long-term performance expectation in exchange for smaller short-term account fluctuations. An options hedging strategy is available for this portfolio.

Conservative Portfolio

Low-Risk Tolerance

The asset allocation mix of stocks, fixed income and cash equivalents has a target equity exposure of approximately 50%. This portfolio is designed for investors who wish to reduce short-term account fluctuations, accepting a lower long-term return expectation as a result. An options hedging strategy is available for this portfolio.