October 24, 2018

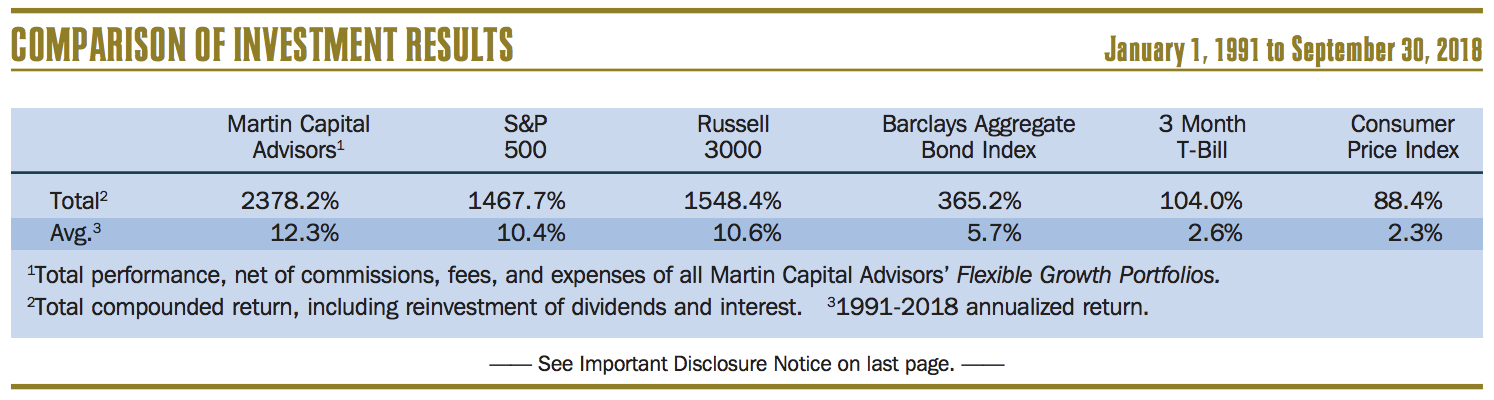

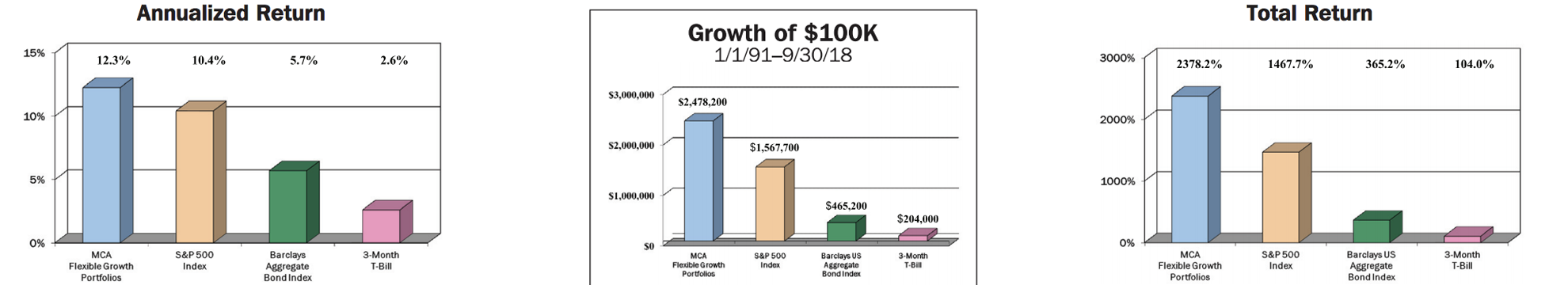

Stocks rallied in the third quarter, with the S&P 500 advancing +7.7%, resulting in a year-to-date return through the end of September of +10.6%. The ongoing strength in corporate earnings has been the primary driver of higher prices for the last two years. Bond returns were flat, with the Barclays Aggregate Bond Index generating 0.0% for the quarter and a year-todate return of –1.6%. Gold continued the down trend it has been in since April and the price of WTI Crude was off slightly for the three months ending September 30, but still up over +20% year-to-date. In a similar fashion to the stock market sell-off that began at the beginning of February, program selling has dampened year-to-date gains thus far in the fourth quarter. While there are some concerns about the prospects for corporate earnings next year, the recent decline in the stock market is not justified by any material weakness in earnings or the economy. The rise in bond yields, which may also have been a catalyst for the recent correction in stocks, has resulted in a further decline in bond prices. Gold prices have bounced back slightly since the beginning of the quarter and WTI Crude Oil has corrected even more than stocks so far in the fourth quarter. Despite the latest weakness in stocks, I remain fairly sanguine about the potential for the economy and corporate earnings, and the consequent potential for higher stock prices over the next year. That said, the Federal Reserve’s Fed Funds rate increases may start to have a significantly negative impact on the economy sometime next year, so it bears closely monitoring the possibility of a severe yield curve inversion and subsequent bear market in the next year or two. However, it is important to keep in mind that we are probably just at the beginning of a multi-generational bull market, so investment portfolios should be skewed towards stocks and their ability to outperform all other investment options over the long run.

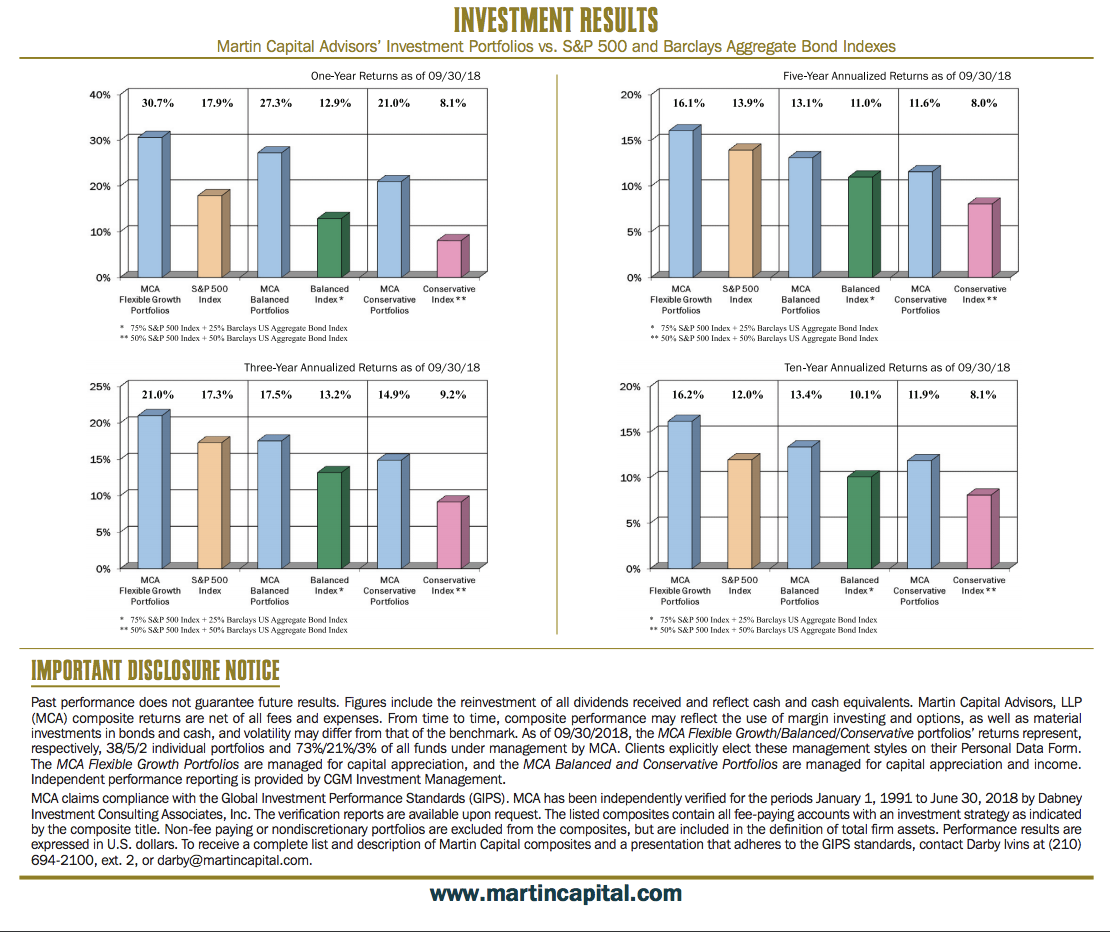

Recent Comments